In an era of geopolitical instability and escalating energy demands, nuclear power emerges as a cornerstone for achieving true energy independence. Unlike fossil fuels subject to volatile international markets or intermittent renewables dependent on weather patterns, nuclear energy provides reliable, low-carbon baseload power. However, the United States’ reliance on foreign suppliers for key nuclear fuel cycle components undermines this potential. This article examines the vital role of domestic uranium conversion and High-Assay Low-Enriched Uranium (HALEU) enrichment in bolstering U.S. energy security, particularly for advanced reactor technologies.

Nuclear Power as a Pillar of Energy Independence

Energy independence entails a nation’s ability to meet its power needs without undue dependence on external sources, thereby mitigating risks from supply disruptions, price manipulations, or sanctions.

The U.S. currently operates 94 commercial reactors, supplying about 20% of the nation’s electricity. Yet, this fleet predominantly relies on light-water reactors using low-enriched uranium (LEU) at enrichment levels below 5%. Advanced reactors, including small modular reactors (SMRs) and Generation IV designs, promise enhanced safety, reduced waste, and greater fuel efficiency. These innovations require HALEU, enriched to between 5% and 20% uranium-235, to achieve higher burnup rates and compact designs.

Without a robust domestic fuel supply chain, even the most advanced reactors cannot contribute to independence. Historical vulnerabilities, such as the 1973 oil embargo or recent disruptions in global uranium trade due to conflicts in supplier nations, underscore this imperative.

UF6 as a Solid

UF6 in Cylinders

The Strategic Importance of Domestic Uranium Conversion

Uranium conversion transforms processed uranium ore (yellowcake) into uranium hexafluoride (UF₆), the gaseous form essential for enrichment. This step bridges raw material extraction and fuel fabrication, forming a critical link in the nuclear fuel cycle.

The United States possesses abundant uranium reserves—estimated at over 500 million pounds in recoverable resources—primarily in states like Wyoming, New Mexico, and Utah. However, the nation’s sole operating conversion facility, located in Metropolis, Illinois, and operated by Honeywell, processes only a fraction of the material needed to produce fuel for the U.S. nuclear fleet. Much of the UF₆ used by domestic fuel fabricators is imported to the U.S. from allies like Canada and Australia, with significant volumes historically sourced from Russia and its satellites.

Unprocessed Uranium Ore

Processed Uranium as “Yellowcake”

Available Conversion Supply at Concerningly Low Levels

Uranium conversion suppliers from Canada, France, Russia, as well as ConverDyn have no conversion to sell until 2029 or later; with very limited supplies until 2031 or later1 . Current market prices are 1000% above 2017 lows with ~8,000 tU of active demand but no conversion sources available. Advanced Reactor vendors are looking to contract for fuel now.

Establishing or expanding domestic conversion capacity is paramount for several reasons:

- Supply Chain Resilience: Foreign dependence exposes the U.S. to export restrictions or political leverage. For instance, Russia’s invasion of Ukraine in 2022 highlighted vulnerabilities, as Russia supplied nearly 20% of U.S. conversion services prior to sanctions.

- Economic and Job Creation Benefits: Domestic facilities would stimulate mining, processing, and related industries, creating high-skilled jobs in rural communities and reducing trade deficits in nuclear materials.

- National Security: Controlling conversion ensures that sensitive technologies and materials remain under U.S. jurisdiction, preventing proliferation risks and aligning with non-proliferation treaties.

Investments under the Inflation Reduction Act and Bipartisan Infrastructure Law have begun addressing this gap, allocating funds for uranium feedstock security. Full independence, however, requires scaling conversion to meet both current and projected demands from advanced reactors.

The Imperative of Domestic HALEU Enrichment for Advanced Reactors

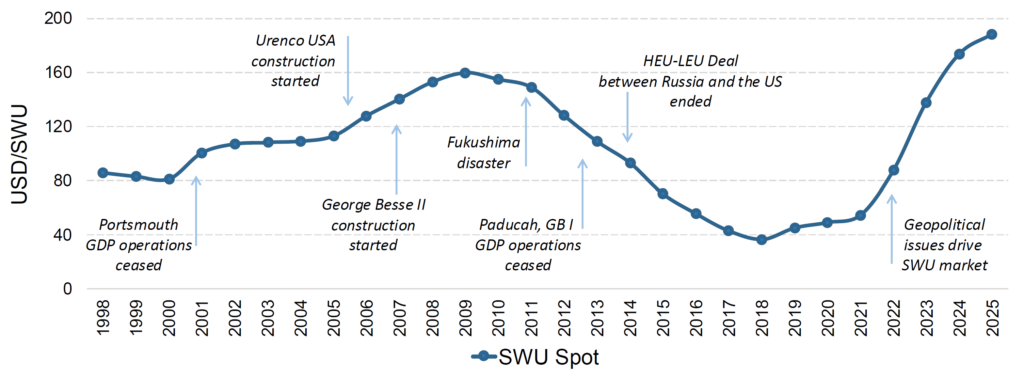

Enrichment increases the concentration of fissile uranium-235 in UF₆ using separative elements such as gas centrifuges. Enrichment services are sold as Separative Work Units (SWU). The U.S. has one LEU enrichment facility operated by Urenco in New Mexico; however, HALEU production remains nascent and heavily reliant on foreign entities.

Russia dominates global HALEU supply through Rosatom, providing over 90% of the world’s capacity via down-blending from decommissioned weapons material. This monopoly poses acute risks: potential embargoes could halt U.S. advanced reactor deployments, as seen with delays in projects like TerraPower’s Natrium reactor or X-energy’s Xe-100.

Domestic HALEU enrichment is essential for the following strategic advantages:

- Enabling Advanced Reactor Deployment: HALEU fuels enable reactors with passive safety features, longer operational cycles (up to 20 years without refueling), and the ability to consume existing nuclear waste. Without it, the U.S. risks ceding leadership in nuclear innovation to competitors like China, which is aggressively expanding its enrichment capabilities.

- Reducing Geopolitical Vulnerabilities: A self-sufficient enrichment infrastructure eliminates leverage from adversarial suppliers. The Department of Energy’s HALEU Availability Program, launched in 2023, aims to produce 20 metric tons annually by 2027 through public-private partnerships, but scaling to commercial levels demands sustained investment.

- Technological Sovereignty and Cost Stability: Domestic production fosters innovation in centrifuge technology, potentially lowering long-term costs and ensuring price predictability amid global market fluctuations.

Companies like Centrus Energy have demonstrated initial HALEU production in Piketon, Ohio, using American-made centrifuges. Expanding such efforts would integrate seamlessly with domestic conversion.

Leave a Reply